BLOG

What is Super App?

Think about the apps you used from the moment you wake up to the time you go to sleep. Ordering meals, checking the weather, communicating, and maybe paying bills; you use separate applications for all of them. You are probably getting lost in the opened tabs, your rush starts right on the phone screen. So where is Super App in this chaos?

We can roughly explain Super Applications as follows; The synergistic combination of dozens of seemingly unrelated services in a single application.

Initially, the first person to use the word Super App was Mike Lazaridis, the founder of BlackBerry.

Defining Super Apps as a closed ecosystem of many applications that people will use daily, Lazaridis predicted that this application could provide an efficient and contextual experience.

Especially in the Asian region known for its large population, the volume of the smartphone market is quite large. 53% of internet users in the world are located in the Asia-Pacific region. China is the largest internet market in the world with approximately 0.8 billion internet users. Due to these reasons, today the Super App phrase has become synonymous with Asia’s rising super products such as WeChat and Alipay. These companies have turned the incoming customer traffic for social media and communication needs into an opportunity. Thanks to the functional services they offer besides to their customers, these applications have accelerated their initiatives.

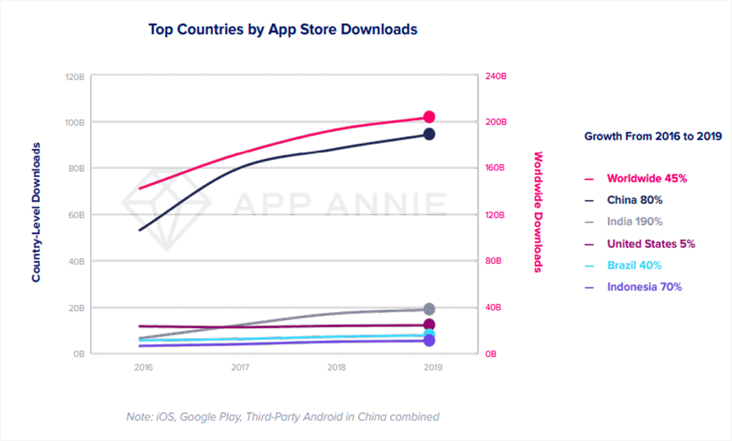

“Consumers downloaded 204 billion apps in 2019 and this number continues to climb. (App Annie) The number of mobile applications downloaded every year is steadily expanding. There were 204 billion app downloads worldwide in 2019 (excluding reinstalls and app updates). As App Annie reports, this is a 45% increase compared to 2016.

In order to make sense of Super Apps in our physical world, we can continue with an example: Shopping centers. We can access all kinds of services we may need during the day through these centers. Super Apps are marketplace services that provide retail space to many businesses, different industries and brands.

Typically, businesses tend to integrate the considerable number of products and services they offer into a super application.

Super App allows you to perform the functions of multiple applications with just one application. Super apps are undeniably advantageous wherever you are! While getting rid of traffic on your phone, you acquire all your work done in just one tab. There is no place for running and chaos in the Super App ecosystem!

We can list the advantages for companies as follows;

- Thanks to the synchronization that will occur automatically on the application base, you will be able to produce pinpoint solutions for your customers’ needs. At the right time, you can organize low-risk product launches with suitable marketing offers to your potential customers.

- Mini applications that can be integrated into the Super App ecosystem will also reduce the product development costs of your business. These applications that allow for updates take a platform-based approach to scale your products.

- Thanks to the additional financial service products (loans, wallets) you can provide to your users, you will have a clear idea of the financial health of your users. Further, you reduce the transaction costs that may occur with third parties (bank, credit card processor).

- KYC (know your customer) data is automatically obtained from the social and financial profiles of your users, covering all habits. Synchronization also reduces the costs of the KYC system, which provides an accelerated beginning for brand-new customers.

Advantages for users;

- It provides a monotype and individual user experience.

- Super apps are created on the principle of simplicity and functionality; Thanks to its user-friendly interface, it is real abundant for users to adapt to the application.

- Thanks to the all-in-one applications, you can easily access third-party services. Tens of application functions in a single structure; your phone memory is also under control.

- These applications work with “machine learning” systems that can process your data. Depending on user experience; They can offer the most appropriate suggestions and remind the invoices to be paid. Just like a virtual assistant living inside the phone!

Minimum effort and maximum satisfaction!

A digital application does not need specific rules to be called Super Application; Characteristics of Super Apps can be shaped according to expectations, needs and customer portfolio. However, indubitably, we can list a few common features;

1. Every Super App has a unique goal. It should offer a digital-financial solution different from other applications in the market.

2. Super App services have a direct connection with their users. There is no need for an intermediary connection to approach applications.

3. Applications offer a service suitable for high demand potential. Let’s say the most used feature of the application is chat; Application functions are developed by adding different features.

4. Super Apps must have a wallet service offered to their customers. Using original payment methods creates a local range of customers.

5. The partnership is critical for applications. The service network can be developed as a result of the collaborations that can be made. The new generation Super Apps are growing due to their strong investments and connections with third parties.

No need intermediaries

Super applications offer an alternative service for users who are accustomed to the central financial system. According to the Kpmg report, 73% of the population in Southeast Asia is unbanked. Sellers that do not accept transactions with credit cards accept payments with your digital wallets. Thanks to these platforms, users can complete their financial transactions within minutes. Applications that tender basic banking transactions such as savings and investments to the use of their customers; They are seen as a potential competitor to the traditional financial system.

Data accumulation convenience

These platforms, which have deep knowledge of their customers, process their data in order to provide more personal service to their users. Through these platforms, which internalize user habits, customers have a fully functional experience.

Mobile Experience

Another development that accelerated the Super App race was insufficient phone memory. This problem, which prevented users from downloading more than once, started to alter consumer behavior. It is not surprising that users prefer these software that offer an all-in-one experience.

Cultural homogeneity

Most Asian countries share a common culture. This factor, which affects the market homogeneity, allows different businesses to offer a uniform service. When a service is launched, demand quickly spreads to nearby areas.

Super applications developed to handle all your transactions aim to be the only tools of our age. According to the internet report published by Cisco, the number of users who can access the internet by 2023 will reach 5.3 billion people. Companies are in a race for innovation so meet the different expectations of so many people about banking and government transactions.

According to user research; The number of applications we use individually in a day is approximately 9. The number of application downloads is climbing faster than ever before. Predictive companies produce alternative solutions to this traffic that may occur; Super Applications!

The Trademark of Super Applications: Mobile Wallets!

As we mentioned in our Character Analysis section, we cannot talk about Super App without wallet service. These applications aim to develop software-based approaches that can radically change consumption habits. As long as wallet software is running on mobile devices, you have a kind of remote control that you can use for banking transactions.

Mobile wallets act as a catalyst for popularizing cashless payment systems. Using this service, users can perform all necessary transactions without physically going to the bank branch. Transparency in business transactions of rural areas, which are relatively remote from the banking system, increases. The secret to using mobile payments is loyalty; consumers interact more with brands they are familiar with and trust. Businesses can also earn consumer loyalty by defining discounts and rewards for mobile wallets.

Wallet services, which we can consider as the star feature of Super Apps, are becoming increasingly common. Federal Reserve research pointed out that 3 out of 10 people are open to cashless payments when the opportunity arises. Users’ interest in mobile payments makes the technology race giant.